Content

So Accounting Information System helps in the secure storage of financial information that is generated at several stages of operation by a firm. An internal control system consists of the policies and procedures that companies use to protect assets, ensure reliable accounting, promote efficient operations, and uphold company policies. How is accounting information prepared by management accountants used within an organization? Your company is growing and you need to update your accounting information system. Previously, the company was small enough to use an off-the-shelf application. Now, you realize you need a better information system to remain competitive.

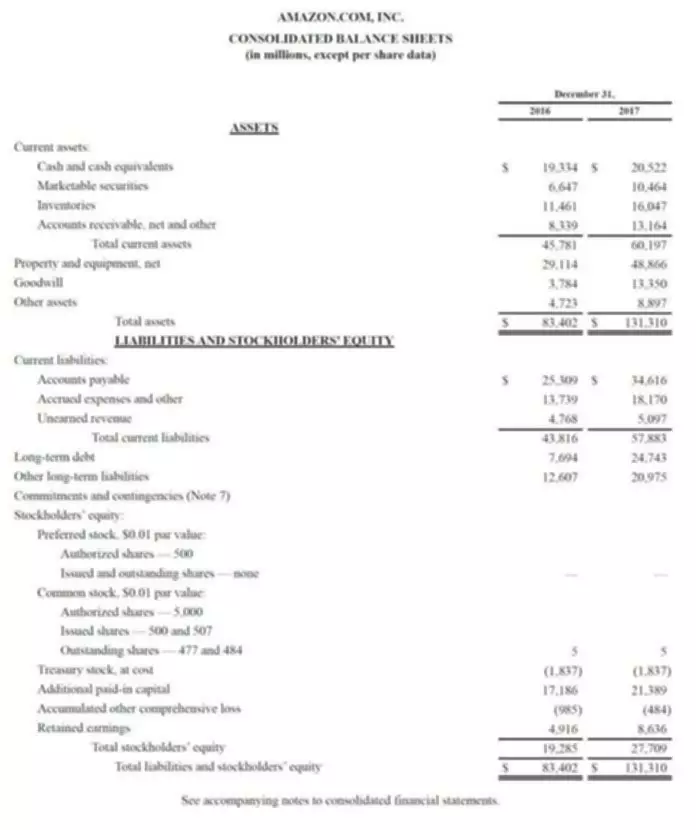

How accounting information helps in decision-making for investors and stakeholders boils down to them seeing your company’s financial health. They can see where your financing sources are, calculate the profitability, and estimate any risks. An accounting information system is basically the use of computers to track every accounting record of a business entity.

The Impact of Accounting Information Systems on the Banks Success: Evidence from Jordan

By doing so, it fulfills the Generally Accepted business accounting Principles . In addition to that, this specialized system has 5 unique components. AIS consultants can also be of great help when it’s time to set up a new information system. They’ll be able to assess and account for contingencies when designing a plan that works for their client.

- It has improved productivity and increased value creation of organizations .

- Depending on the school, students may be able to get a focused education in AIS with a special certificate program.

- AIS specialists who opt to go down the accounting or auditing route can also expect to enjoy a positive career outlook.

- So several measures are taken for cyber-security in order to protect sensitive data.

- They are planning to opt for a cheap and effective Accounting Information System.

- Financial ratios use the accounting information reported on financial statements and break it down into leading indicators.

- Such a tool is called ERP- Enterprise Resource Planning solutions.

Modern processors are able to process bulky accounting information in seconds. CPAs can add an additional certification to their training with the Certified Information Technology Professional Credential. To earn this designation, accountants must show an understanding of information management, risk assessment and management, fraud prevention, and internal controls. Candidates must also pass an exam, which costs $300 in fees and takes about four hours to complete.

How do business owners use account information?

According to Samuel , https://www.bookstime.com/ Information Systems support the control of business activities and are very essential tools in achieving operational efficiency within organizations. AIS has improved the activities of accounting departments by providing timely accounting information which gives management a clearer and bigger picture of business operations and enables them to make well-informed decisions. It leads to efficient and effective record keeping with the use of computerized systems . According to Pepper , with the help of Accounting Information Systems, accountants have moved from desk work which took long periods involved lots of paperwork to more advanced ways of performing their tasks. It has also been beneficial to organizations adopting its use for their operations. Furthermore, Wood asserts that firms adopting this technology are more efficient, with greater margins and better service levels.

Material resource planning software is the portion of the ERP system controlling inventories. There are multiple types or categories of accounting information systems. What a business firm uses depends on the type of business, the size of the business, the needs of the business, and the sophistication of the business. The business transactions that fall under these business processes are large volumes of expenditure, returns, and cash outflow transactions.